Curious about the cost of senior funeral insurance in Australia? Well, you’re not alone! It’s essential to know what to expect when planning for the future and securing your loved ones’ financial well-being. Funeral insurance plays a vital role in providing peace of mind during challenging times, but the costs can vary based on several factors. For seniors, the average cost of burial insurance in Australia can be influenced by various elements like age, coverage amount, and health conditions. As the demand for funeral insurance grows, the industry has been evolving to cater to the diverse needs of individuals and families across the country. So, let’s dive in and explore the ins and outs of funeral insurance costs, helping you make informed decisions and find the best fit for your unique situation.

What is the Cost of Senior Funeral Insurance in Australia?

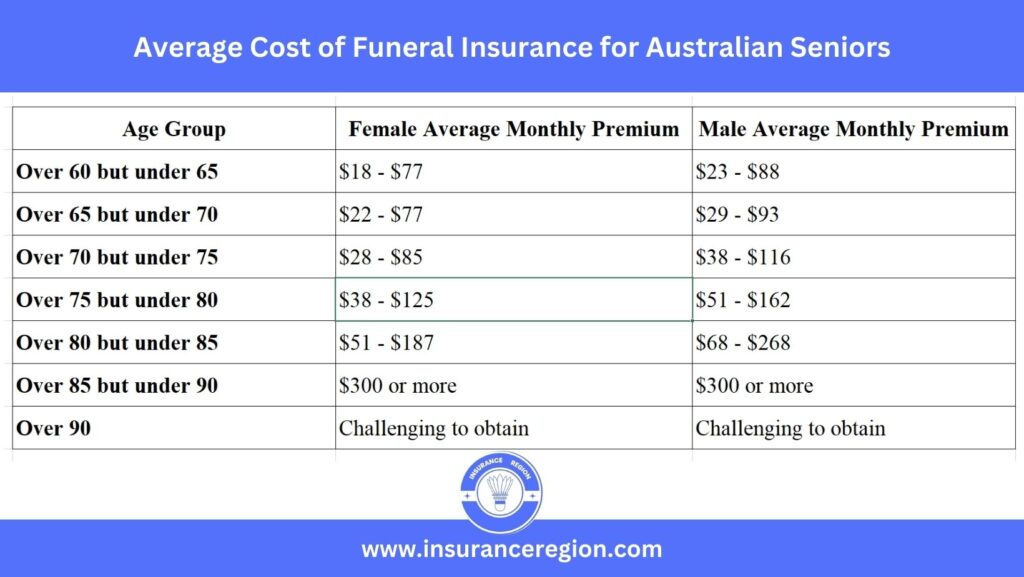

According to finder, most policies for seniors offer benefits from $5,000 to $20,000 for people between 50 and 85 years old. Some insurers may have higher or lower age limits for their plans. Many seniors choose to buy a $10,000 policy to help pay for their funeral expenses. So for a burial insurance policy of $5,000 or $10,000, here are some examples of what you might pay based on your age. See how to get cheap funeral insurance in Australia

Cost of Senior Funeral Insurance Over 60 Years in Australia

Funeral insurance premiums for individuals aged over 60 but still under 65 varies between $18 and $88 per month. Women generally have slightly lower average premiums compared to men, with a difference of approximately $5 to $10 per month. On average, senior women may expect to pay between $18 and $77 per month, while senior men may face premiums ranging from $23 to $88 per month.

Advertisements

Cost of Senior Funeral Insurance Over 65 Years in Australia

Funeral insurance for individuals who is over the age of 65 but under the age 70 typically falls within the price range of $22 to $93. Generally, women tend to have lower insurance premiums compared to men. The average cost for women in this age group ranges from $22 to $77, while for men, it varies from $29 to $93 monthly.

Cost of Funeral Insurance Over 70 Years Old Australian Seniors

The cost of final expense insurance for individuals over the age of 70 and under 75 years typically falls between $28 and $116. Generally, women tend to have lower insurance rates compared to men. The average cost for senior women ranges from $28 to $85, while senior men can expect to pay between $38 and $116 for this type of insurance.

Funeral Insurance Over 75 Years Old Australian Seniors

The cost of burial insurance for individuals aged over 75 but under 80 typically falls within the range of $38 to $162. In general, women tend to have lower insurance premiums compared to men. For senior women, the average cost ranges from $38 to $125, while senior men can expect a cost between $51 to $162.

Funeral Insurance Over 80 Years Old Australian Seniors

The average cost of funeral insurance for over 80 and under 85 can years old Australian senior range between $51 to $268. On average, women are cheaper to insure than men. The average cost for senior women ranges from $51 to $187, while the cost for senior men ranges from $68 to $268.

Cost of Funeral Insurance Over 85 Years Old Australian Seniors

The average cost of final expense insurance over 85 and under 90 can be as high as $300 or more.

Cost of Funeral Insurance Over 90 Years Old Australian Seniors

Securing insurance coverage for individuals over the age of 90 can be challenging, as many insurers are hesitant to offer such policies. If you do manage to get accepted, anticipate paying significantly higher premiums. However, you can consider prepaid funeral plans as a close alternative.

The table below summarize the cost of funeral insurance for seniors in Australia.

What Are The Factors Influencing Funeral Insurance Cost?

If you are looking for a life insurance policy as a senior, you should know that different factors can affect your rates. These include your age, sex, how much coverage you want, and whether you have to answer any medical questions.

Age of the Applicant

Funeral insurance costs are significantly influenced by the age of the applicant. Insurance providers consider age as a crucial factor because it directly affects the risk of a claim being made. Younger applicants are generally considered to be lower risk since they are less likely to have immediate health concerns or pre-existing conditions. As a result, younger individuals can often secure funeral insurance at a lower premium.

Coverage Amount

The coverage amount in funeral insurance refers to the sum of money that will be paid out to the beneficiary upon the policyholder’s passing. The coverage amount directly affects the premium cost, as higher coverage typically leads to higher premiums. Insurance providers assess the risk they are undertaking by offering coverage, and the higher the coverage amount, the greater the potential financial liability for the insurer. As a result, policyholders seeking extensive coverage to cover comprehensive funeral expenses can expect to pay higher premiums to offset the increased risk for the insurance company.

Health and Medical History

This play a significant role in determining funeral insurance costs. When applying for funeral insurance, insurers consider the applicant’s health and medical conditions to assess their risk profile. A clean bill of health may result in lower premiums, while certain pre-existing conditions could lead to higher premium amounts or coverage limitations.

Waiting Period

The waiting period in funeral insurance refers to the period between policy inception and the time when the full coverage comes into effect. During this waiting period, the policyholder may not receive the full benefit payout in case of death. Understanding the waiting period is crucial in comprehending how it influences the overall cost of funeral insurance.